bear trap stock example

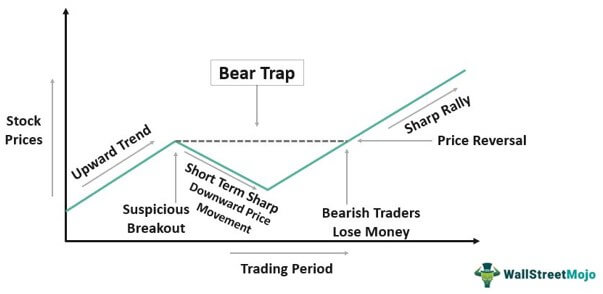

Its a technical pattern where the price dips or starts falling then quickly. The bull trap is always created around an important market area or level.

3 Bear Trap Chart Patterns You Don T Know

A bear trap results in a stock that appears to be taking a turn for the worse only to rebound quickly.

. A bear trap is a false selling signal that occurs when an equity that has been in a bullish pattern quickly breaks to the downside. A bear trap is common when trading various assets such as stocks currencies and commodities. In the example above if you shorted XYZ and the stock is currently worth 50 youd need at least 15 in your account for each share you shorted.

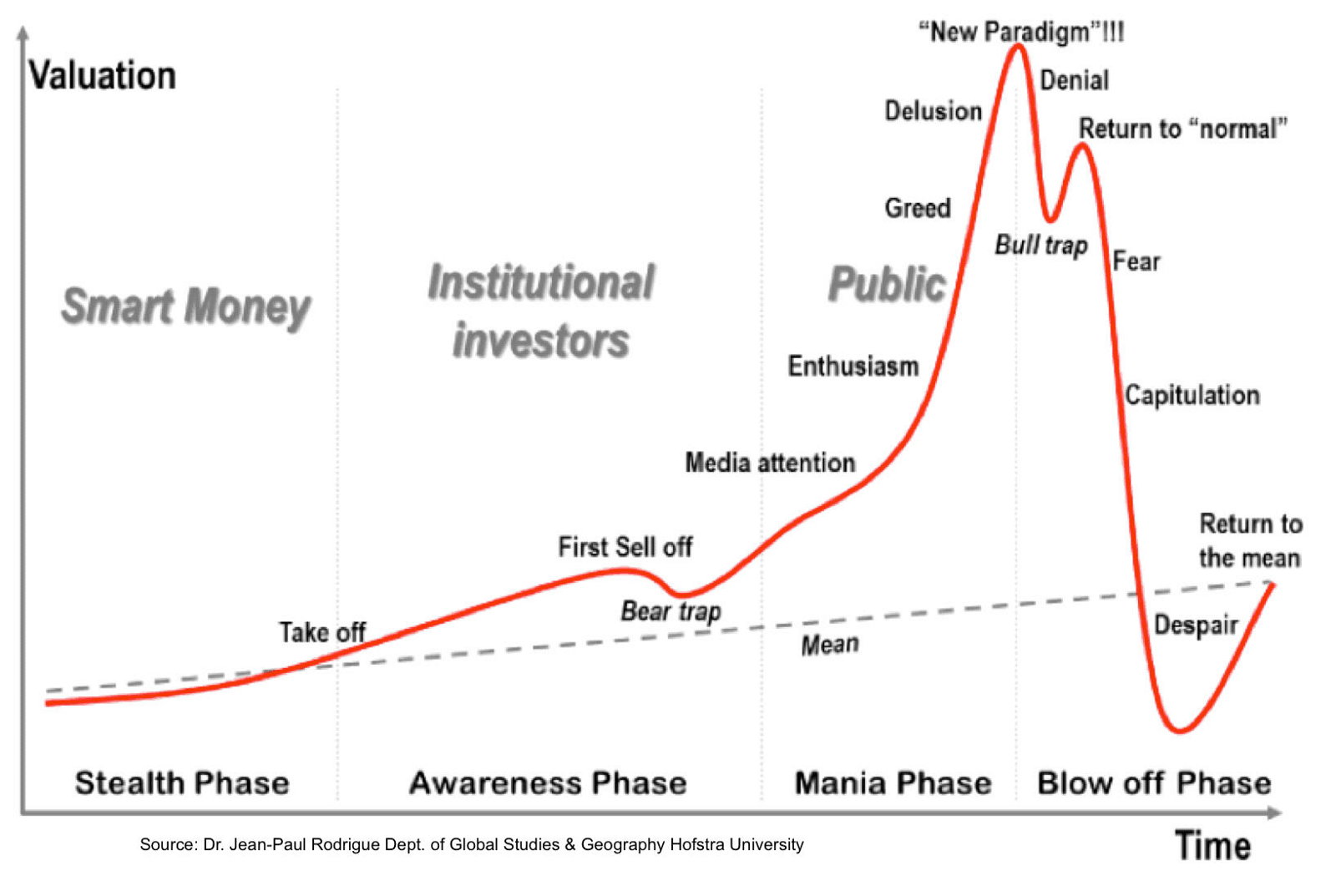

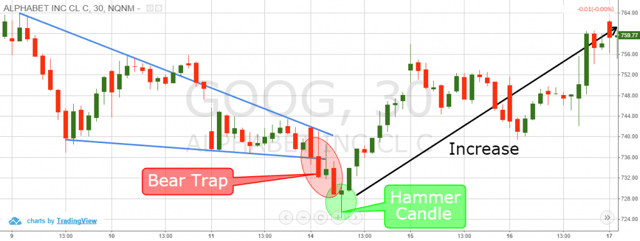

Essentially its a relatively sudden movement in a stock or in the broad market that lures in. How to Identify a Bull Trap. A bear trap in trading is a technical reversal pattern at the bottom.

A bear trap is a colloquial name for a particular trading pattern in the stock market. Technical traders use a number of analytical techniques to avoid bear traps. For example in the past poker legends like Doyle Brunson would just play.

The above is a real-life example of a bull trap in the Honeywell HON stock market. If XYZ rises to 100 you. This can be an area such as a major moving average but it is often a major resistance.

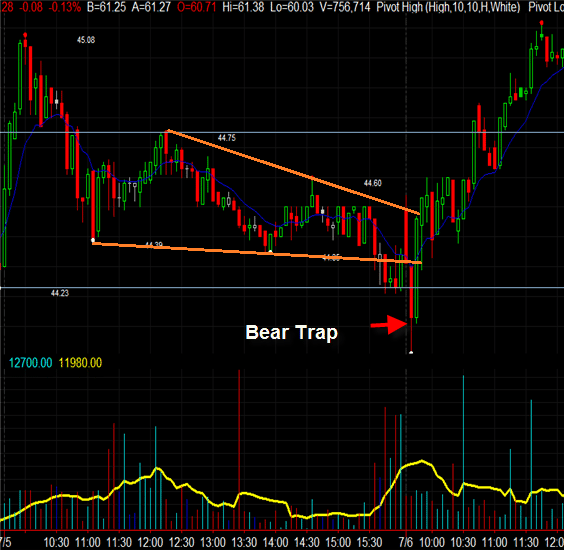

Type a symbol or company name. Investors and traders take short positions. Below is an example of a bear trap on 76 for the stock.

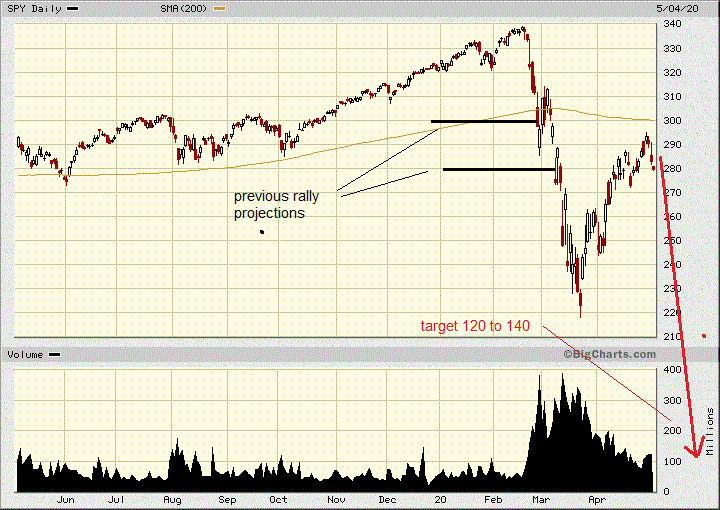

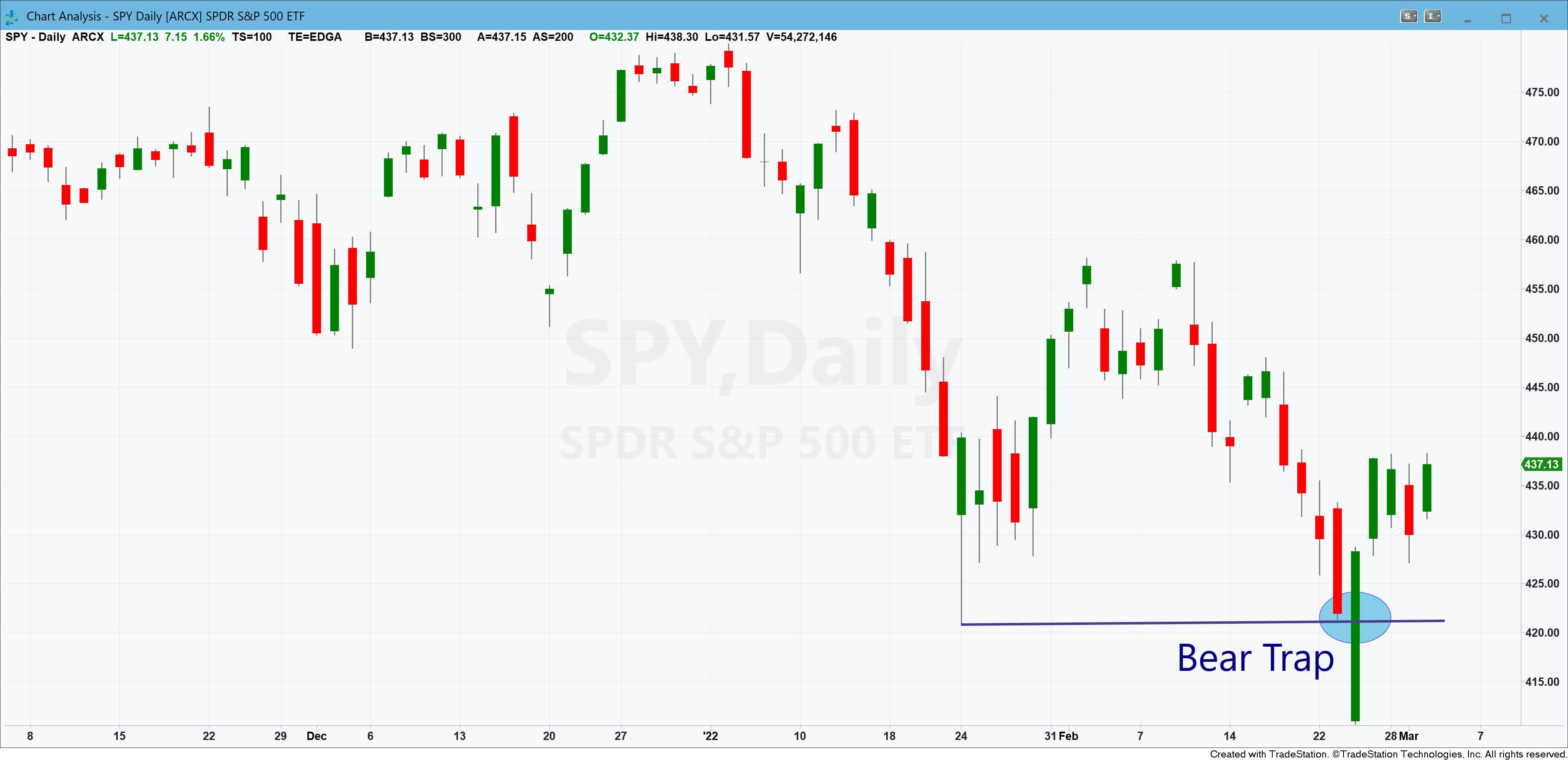

For a bear trap chart example consider a scenario where traders were watching a key support level of 425 on the. It can be harmful to investors taking a short position in the. And the best way for investors like Jim Chanos and David Einhorn who are.

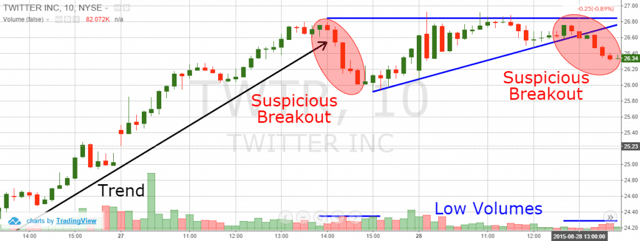

In this example the security sells off and hits a new 52-week low before rebounding sharply on high volume and lifting into trendline resistance. For example Fibonacci retracements relative strength oscillators and volume indicators. The stock price had seemed to break out of resistance levels and was on an uptrend.

The pattern gives a false signal for the continuation of the downtrend encouraging traders to open short positions. A Bear Trap is a deliberate move by the big institutional players to trap traders into thinking there is a Short trade. Below is an example of a bear trap on 76 for the stock Agrium Inc.

When the symbol you want to add appears add it to Watchlist by selecting it and pressing EnterReturn. You will notice that the stock broke to fresh two-day lows before having a sharp counter move higher. Bear Trap Example Tesla stock has gone from 1 to over 500 times that price in just five years.

Bear Trap Stock Trading Definition Example How It Works

What Is A Bull Trap In Trading And How To Avoid It

What Is A Bear Trap On The Stock Market Fx Leaders

Bull Trap Vs Bear Trap How To Identify Them Phemex Academy

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Explained For Beginners Warrior Trading

The Great Bear Trap Bull Trap Seeking Alpha

The Great Bear Trap Bull Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

Bear Trap Explained For Beginners Warrior Trading

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap Seeking Alpha

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim

What Is A Bear Trap On The Stock Market Fx Leaders

What Is A Bear Trap On The Stock Market Fx Leaders

Bear Trap Best Strategies To Profit From Short Squeezes Tradingsim